Tokenization is a form of asset digitisation. Assets or usage rights can be converted into digital “tokens” based on blockchain technology. The possibilities are unlimited. Consider, for example, converting shares into tokens via ‘smart contracts’ or digitising paintings into tokens via NFTs, so-called ‘asset tokenization’.

Tokenization thus offers the possibility to no longer physically transfer assets or rights, but to deliver them digitally via blockchain technology. The crypto financing lawyers of VIOTTA are happy to explain the possibilities in the realm of tokens.

Tokens in a nutshell

A token is a unique element in the Blockchain that cannot be spent twice. The tokens are held in a digital wallet, a wallet such as, for example, ‘Metamask’.

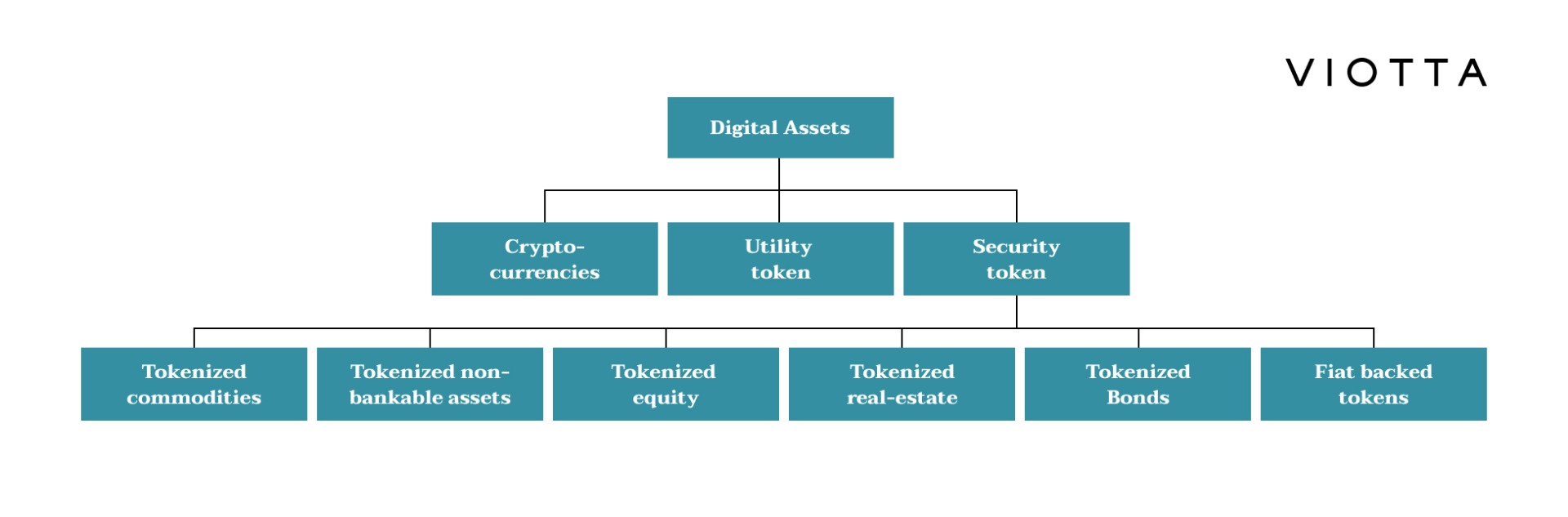

The tokens can be sold and transferred to other wallets via public and private keys. There are different types of ‘tokens’, each with their own function, whether or not on their own blockchain (on-chain).

Examples of tokens

A few prime examples include:

- payment tokens: a payment function such as Bitcoin or Ethereum, but also unique tokens that are distributed in a closed environment (such as “Diem”, the former token of Facebook) to pay for its functionalities in that environment;

- dao tokens: decentralized autonomous organizations (or: DAO) are often referred to as the future. In a so-called DAO, tokens are distributed on the basis of ‘smart contracts’. Holders of these tokens receive (control and profit) rights in this DAO, also known as ‘security tokens’ (see below). This article explains the DAO in more detail [hyperlink];

- asset tokens: this type of token converts assets, such as a piece of gold, equity on a house or a painting, into tokens. The holder of this token can therefore easily transfer the right to those assets. Any asset can be made digitally transferable via tokenization;

- security tokens: security tokens are created in a ‘security token offering’ and are issued on an existing blockchain (for example, the Polygon network). The main purpose of security tokens is to obtain investments, as these tokens entail rights and obligations (in a DAO, for example) for the holders. Regulation of security tokens is still in its infancy. This article explains the security token in more detail.

The legal qualification differs per token and depends on the rights and obligations associated with the token. Read more about this in the following article.

The benefits of tokenization

The possibilities are endless, as tokenization allows for both fractional ownership and proof-of-ownership. The latter is advantageous, since ownership can easily be determined via a token. The holder of, for example, an NFT is automatically the sole owner of that (digital) work of art. Another advantage is that certain goods, services or assets can be made easily accessible via tokens. A couple of examples from real estate:

- One can convert the equity of a house into 100 (asset) tokens. As a result, the surplus value on real estate, for example, can easily be converted into money, and the holders of the tokens benefit from any increase in value. These tokens become more valuable as the value increases and can easily be traded again.

- It’s also possible to tokenize the rental income of a large real estate portfolio. The certificates of a real estate fund are converted into tokens on the Ethereum blockchain. Token holders are entitled to the economic advantage resulting from the legal entity (the real estate fund), namely the rental income minus the management costs.

The tokens in the examples above can be traded easily and worldwide.

The disadvantages of tokenization

The disadvantage of tokens is that their intrinsic value can be diffuse, and that this value is determined based on the code in the ‘smart contract’. What if that code turns out to be defective? A lack of evidential value is therefore inherent in this strand of automation.

And suppose a token can eventually be distributed to someone residing in Thailand. In what way can this person ultimately win in court, for example? This is often laid down in the underlying contracts, but it can form a significant obstacle to litigating from Thailand in, for example, London.

The Netherlands is an ideal country for decentralized finance

Research shows that the Netherlands, together with Switzerland and Germany, is one of the most suitable countries in Europe for holding security tokens, in combination with a DAO for example.

These security tokens can then be linked to the Netherlands in the ‘smart contract’, which means that the holder can enjoy, among other things, Dutch tax benefits. It’s imperative to properly record this in the ‘smart contract’.

Need advice on Asset Tokenization? VIOTTA is happy to help you

For all the reasons listed above, it’s crucial to remain cautious about the digital conversion of goods and values into tokens. Creating a legally correct bridge between assets and decentralized finance on the Blockchain requires multidisciplinary lawyers with specialist crypto knowledge of this very rapidly developing field of law. If you have any questions, don’t hesitate to contact us.